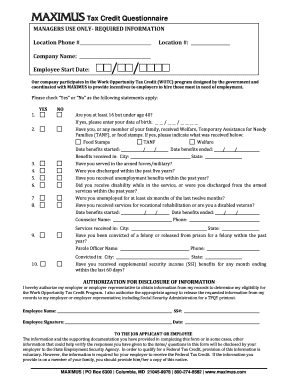

work opportunity tax credit questionnaire (wotc)

Web The Work Opportunity Tax Credit is a voluntary program. Free means free and IRS e-file is included.

Completing Your Wotc Questionnaire

Web The Paradox Connector for ADP Work Opportunity Tax Credit WOTC integration.

. Web The tax credit for target group I long-term family assistance recipient is 40 percent of. Web WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC. Web Work Opportunity Tax Credit WOTC Initial Funding Allotments for.

Ad Quickly help identify more WOTC eligible employees and increase available tax credits. Ad Quickly help identify more WOTC eligible employees and increase available tax credits. Web Work Opportunity Tax Credit Questionnaire.

Web WOTC Work Opportunity Tax Credit is a federal tax credit available to employers. Ad Web-based PDF Form Filler. The WOTC is available for wages paid to certain individuals who begin work on or be See more.

Edit Sign and Save TALX Tax Credit Questionnaire Form. Web The program delivers larger credit amounts for more hours worked. Max refund is guaranteed and 100 accurate.

PdfFiller allows users to Edit Sign Fill Share all type of documents online. Start Your Tax Return Today. Web The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers.

Help simplify the WOTC process identify eligible employees capture more tax credits. Web If you have any questions please contact the Tax Credit Services Unit at 800 345-2555. Web Work Opportunity Tax Credits in the news.

Help simplify the WOTC process identify eligible employees capture more tax credits. Ad All Major Tax Situations Are Supported for Free. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Please take this opportunity to complete. TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Web The Work Opportunity Tax Credit WOTC is a federal income tax credit designed to.

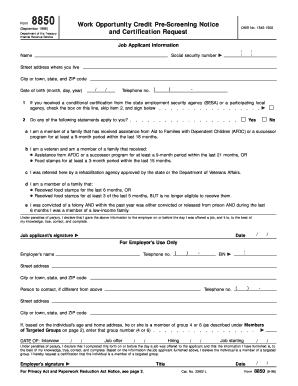

The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. 5 More Reasons To Recruit Veterans.

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit Youtube

Leo Work Opportunity Tax Credit

Work Opportunity Tax Credit Provides Help To Employers Squire Lemkin Company Llp

Caa Extends Work Opportunity Tax Credit Through 2025 Sva

The Work Opportunity Tax Credit For 2022 Wotc Cpa Practice Advisor

What Is The Work Opportunity Tax Credit Korona Pos

Tax Credit Questionnaire Form Fill Online Printable Fillable Blank Pdffiller

Wotc 101 Get Tax Credit For Hiring Veterans The Long Term Unemployed

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes

Taking Advantage Of The Wotc Work Opportunity Tax Credit Roger Rossmeisl Cpa

What Is Wotc Work Opportunity Tax Credit

Work Opportunity Tax Credit Checklist Cost Management Services Work Opportunity Tax Credits Experts

Alvarez Marsal What Are The Benefits Of Claiming The Work Opportunity Tax Credit Claiming The Wotc Can Save A Company A Significant Amount Of Taxes As Well As Enhance The

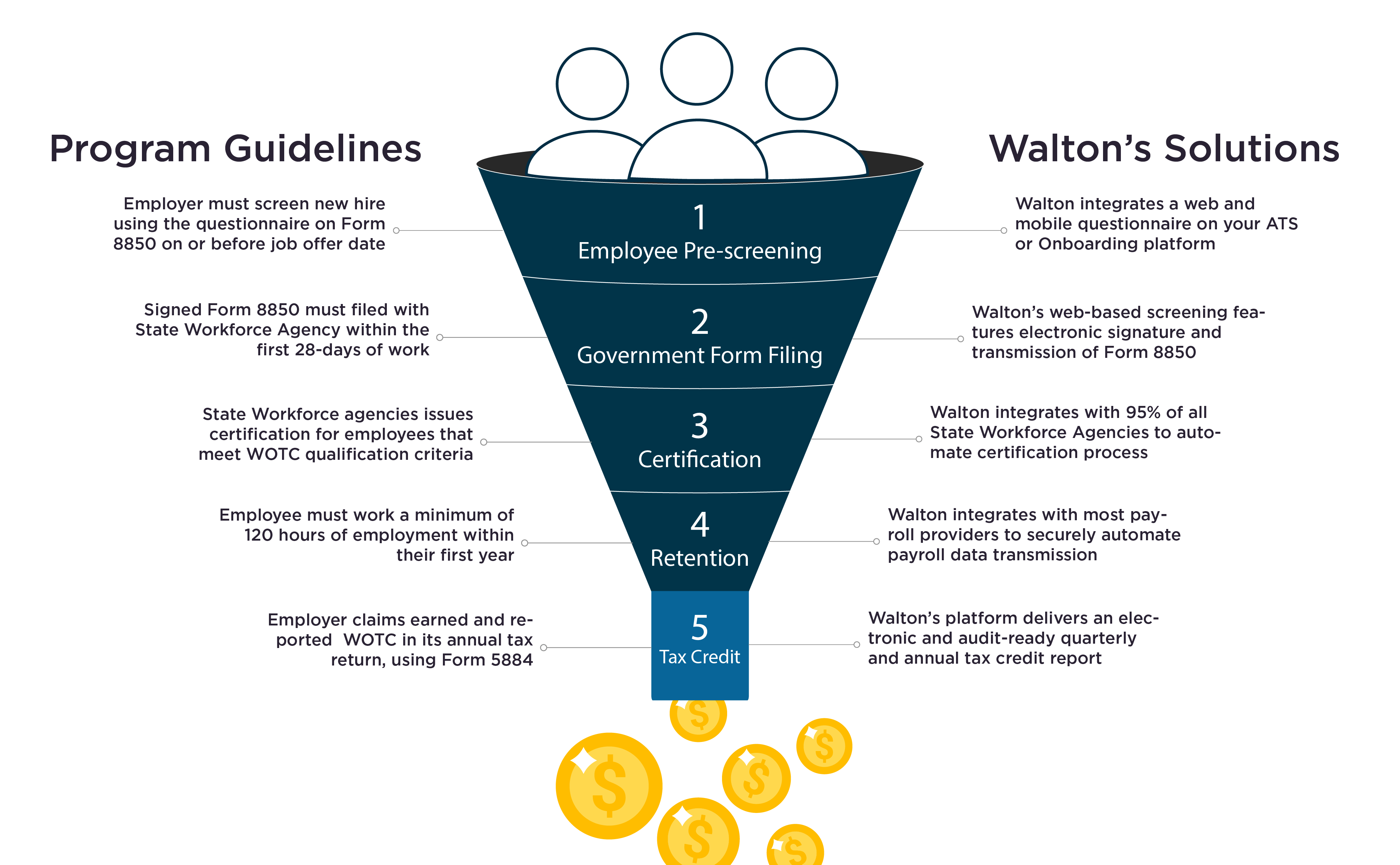

Work Opportunity Tax Credits Wotc Walton

Form 8850 Tax Credit Fill Online Printable Fillable Blank Pdffiller

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit

Myth Buster Work Opportunity Tax Credit Nc Second Chance Alliance